Summary

The fastest path to business value isn’t a bigger data lake. It’s a single, policy-governed source of truth that standardizes meaning across siloed systems, makes knowledge discoverable by agents, and enforces compliance by design. This post lays out a practical, ontology‑guided architecture backed by a Neo4j knowledge graph and a multi-agent orchestration that reduces management overhead while accelerating decision-making and regulatory adherence. We propose using agents powered by emerging communication protocols such as MCP, A2A, and AG-UI to drive domain outcomes across the enterprise, illustrated through a banking case study that transforms loan underwriting from days to hours.

The Business Problem

- Silos and inconsistency: The same “customer” or “contract” is defined and recorded differently across systems, creating reconciliation effort and decision risk.

- Low discoverability: Underwriters and AI agents spend more time locating borrower relationships, asset details and regulatory documents than making credit decisions.

- Operational drag: ETL sprawl, schema drift, and brittle integrations inflate total cost of ownership.

- Compliance exposure: KYC/AML checks, PII, retention policies, and audit trails are duplicated or applied late (or not at all) across platforms.

What enterprises need is not a bigger database, but a single source of truth (SSOT) that standardizes meaning through shared ontology, links structured and unstructured data where it lives, exposes knowledge to AI agents and humans through graphs and retrieval-augmented generation, and enforces policy-as-code so compliance is built in, not bolted on.

A Modern SSOT: Semantic, Linked, Governed

- Defines meaning once via a domain ontology, such as FIBO for banking, capturing entities, relationships, events, and policies.

- Links knowledge to source systems, connecting meaning to where data lives by integrating with APIs, databases, and document repositories rather than copying data.

- Exposes knowledge to people and agents through graph traversal and retrieval‑augmented generation (RAG).

- Enforces policy‑as‑code for classification, access, retention, and lineage, ensuring compliance is applied consistently.

Outcome: Lower management overhead, faster discovery, fewer integration breaks, explainable decisions and audit‑ready operations.

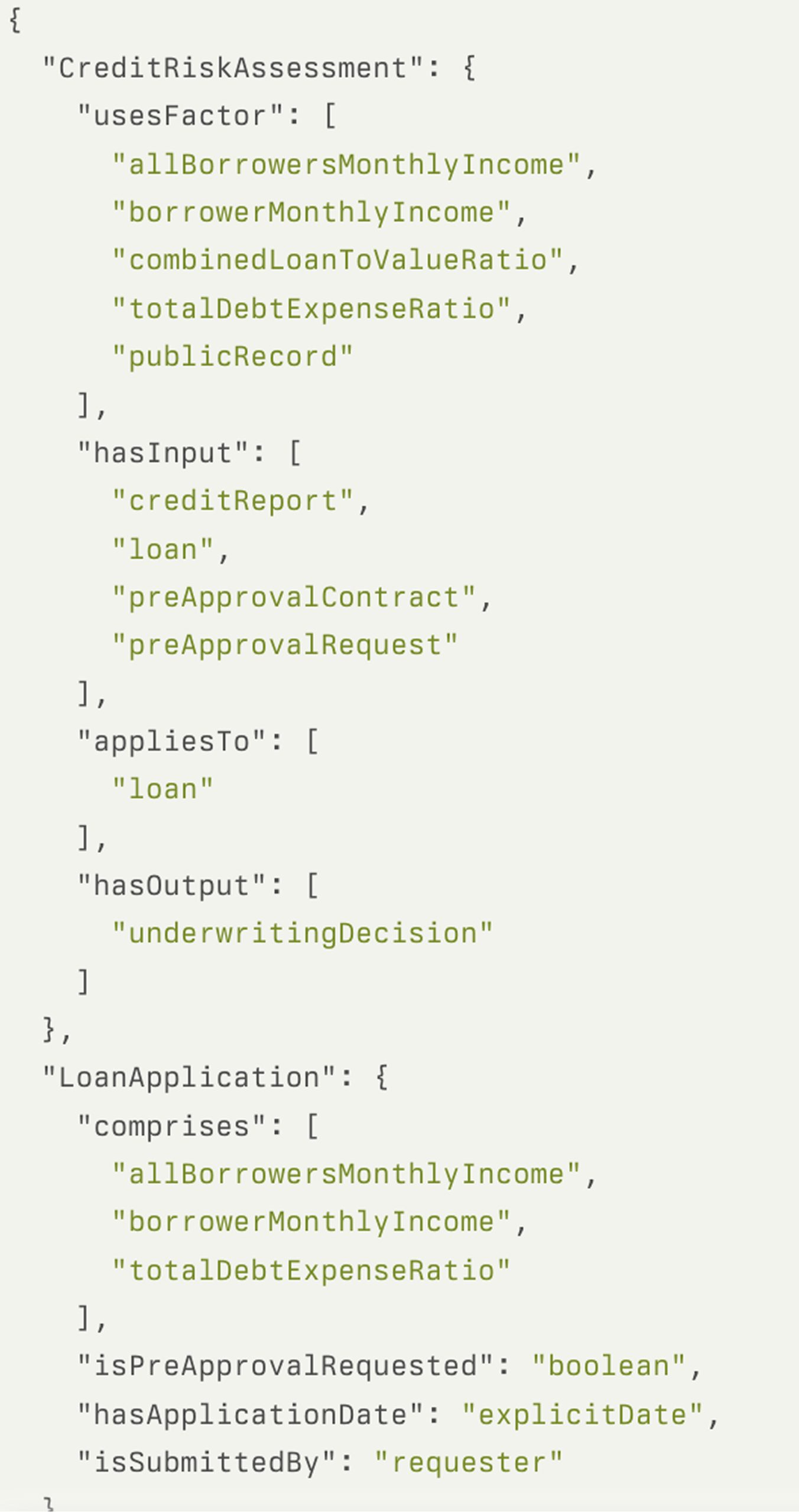

Ontology‑Guided Approach (The Heart of the Solution)

Ontology is the shared language of the business. It defines core entities such as Borrower, Loan Application, Asset, Liability, Employment, Risk Indicator, their attributes, and how they relate to one another.

What ontology encodes

- Core entities and relationships: For example, (Borrower)–OWNS→(Asset); (Borrower)–APPLIED_FOR→(LoanApplication); (Asset)–PLEDGED_AS_COLLATERAL→(LoanApplication).

- Taxonomies and glossaries: Standard terms, synonyms, acronyms such as “Debt-to-Income Ratio = Total Monthly Debt / Gross Monthly Income”.

- Constraints and rules: For example, “Loans over $250K require third-party asset verification, or defaults trigger seven-year record retention”.

- Mappings to sources: Which tables, loan systems APIs, or documents represent each concept.

- Security and sensitivity: PII/PHI classifications such as SSN or bank account details, and ABAC/RBAC labels for loan officers, front office users, and compliance reviewers.

How it powers the platform

- Guides document intelligence to extract structured borrower data from financial statements, tax returns and bank statements, populating the graph with verified facts.

- Drives data discovery through graph traversal and semantic embedding search.

- Anchors agent reasoning. Multi-agent workflows for document processing, risk assessment, fraud detection, and compliance reason in ontology terms, ensuring consistency.

- Enables policy enforcement by applying compliance rules consistently across systems and user interfaces.

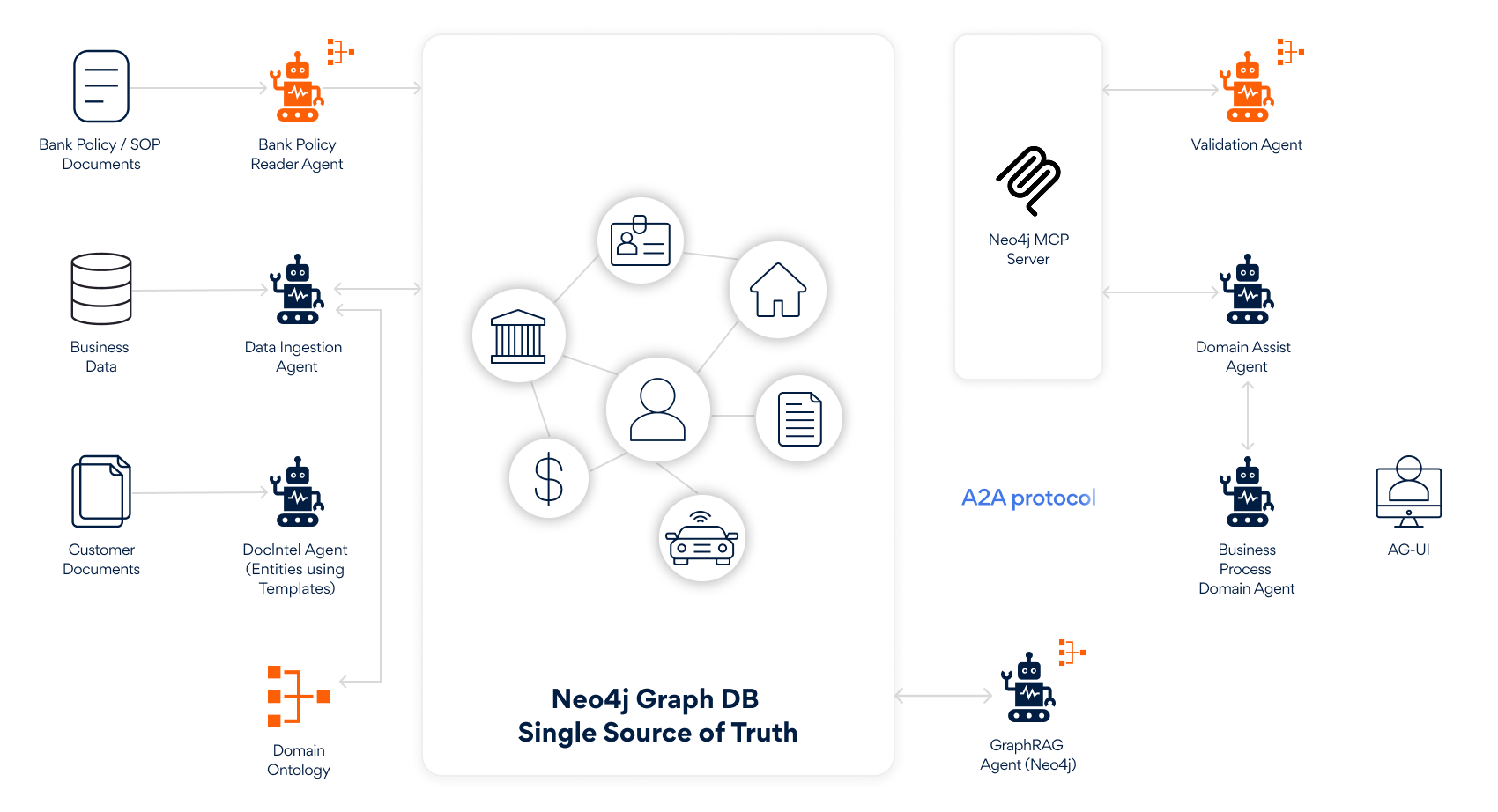

Architecture Deep Dive

Data Sources & Policy Corpus

- Business data: Systems of record such as banking platforms and loan origination systems, data lake or warehouse, SaaS APIs, logs, and domain data products.

- Policy / SOP documents: PDFs, Word docs and wiki pages containing underwriting guidelines, KYC/AML procedures, risk assessment rubrics and regulatory compliance checklists.

- Key design choice: Prefer links from the graph back to source systems instead of duplicating data. Copy only when necessary for performance or offline analytics.

- Domain ontology: A versioned, governed model of the business that serves as the schema of meaning across the platform, such as FIBO (Financial Industry Business Ontology) for financial services.

Core Platform Components

Neo4j Graph Database: Stores borrower profiles, loan applications, assets, transaction histories, relationships such as fraud networks and employment verification, policies, lineage, and security tags. Vector embeddings enable semantic search across documents and borrower attributes.

Multi-Agent Orchestration Layer (Neo4j Aura Agents + LangGraph):

- Document Intelligence Agent: Extracts borrower financials, employment, and asset data from PDFs with human-in-the-loop curation.

- Data Ingestion Agent: Ingests extracted data using the ontology as a reference to generate structured statements for loading into the Neo4j graph.

- Neo4j Aura Agents: Use GraphRAG to provide explainable, context-aware responses by combining structured graph knowledge with language models such as violation identification and collateral analysis.

- LangGraph Agents: Domain specific agents that combine graph data with external sources, such as a Credit Agent.

MCP (Model Context Protocol)

Standardizes how agents query the knowledge graph and retrieve policy documents, enabling interoperability across agent ecosystems.

A2A (Agent‑to‑Agent Layer)

A secure, observable contract layer for agent collaboration with policy guardrails such as classification, purpose limitation and minimization. Agents may be hosted across different ecosystems and connected through a common identity plane using the A2A protocol.

AG‑UI + Monitoring

Graph‑grounded RAG with citations, explainability through links to nodes, edges and document passages, feedback loops for continuous improvement, and telemetry for accuracy, latency and policy hits.

Example Artifacts

Ontology snippet (JSON)

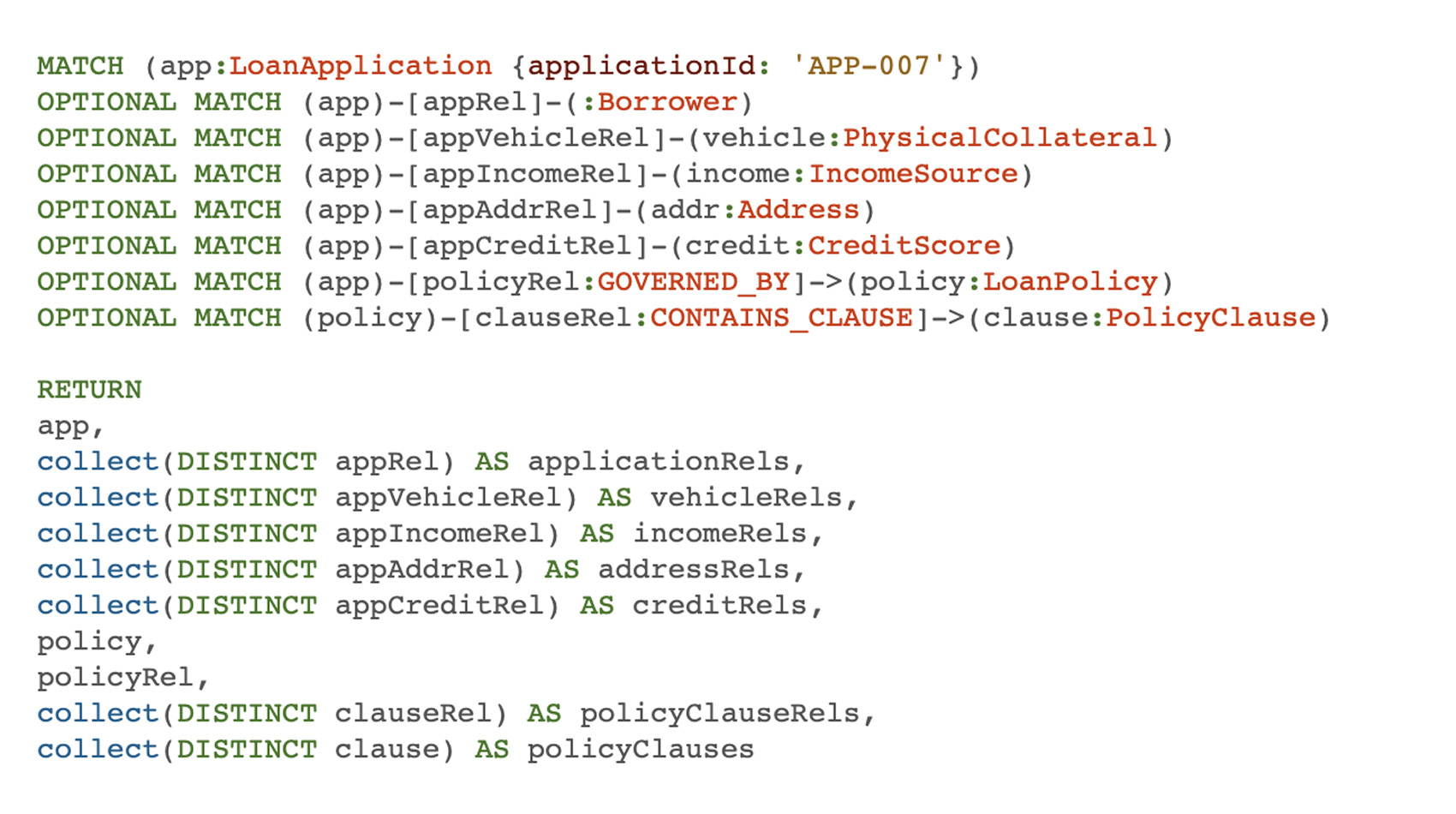

Cypher example (Neo4j)

// Find about certain application details and any violation done against bank policy document

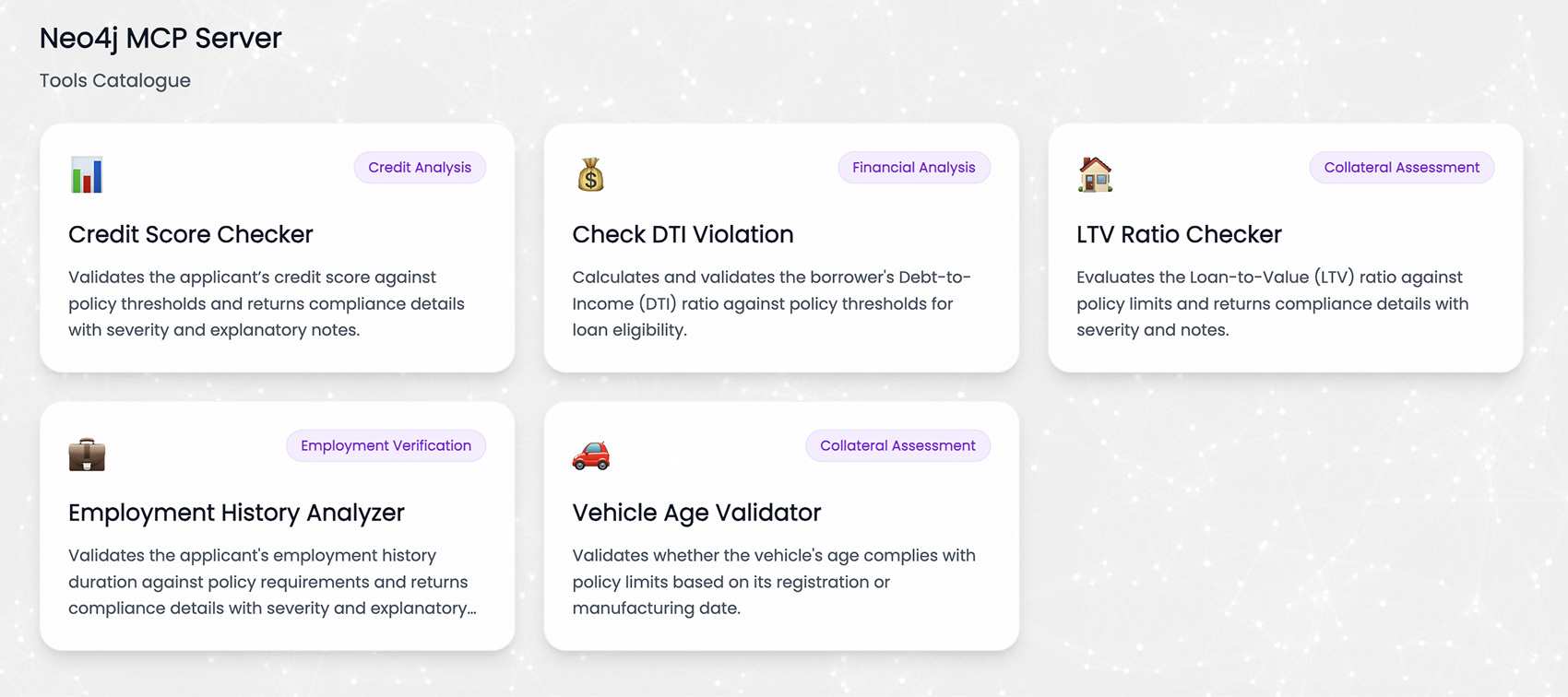

Tools Catalog On MCP Server

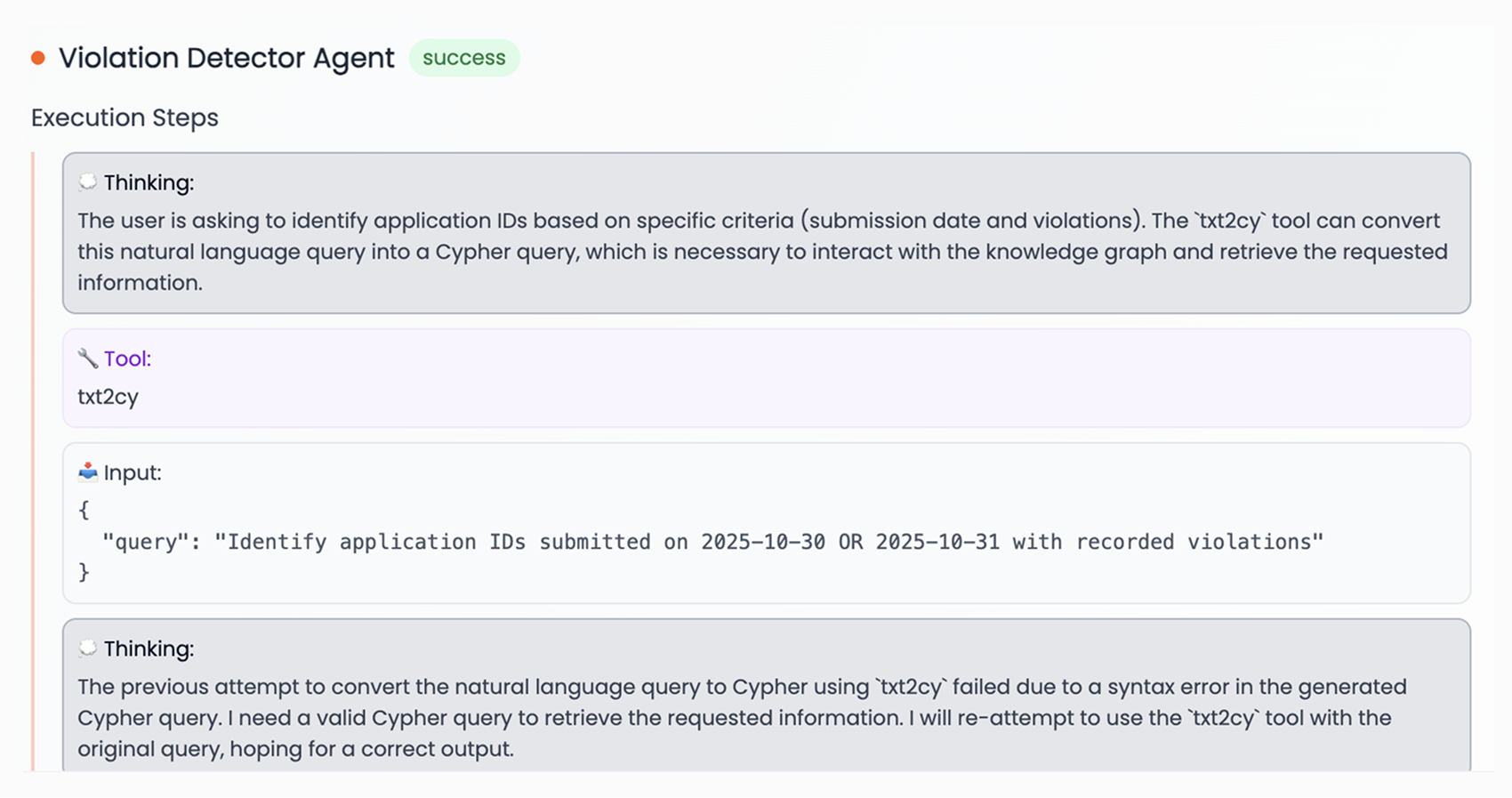

Agent Logs Example

As organizations work to overcome data silos, compliance risk, and operational inefficiency, ontology-driven SSOT architectures represent a clear shift in enterprise knowledge management. By unifying semantics, linking knowledge to authoritative sources and empowering both people and AI agents with explainable, policy-enforced insights, enterprises can enable faster, more reliable decision-making while reducing overhead. Combined with multi-agent orchestration, graph intelligence, and protocols such as MCP, A2A, and AG-UI, enterprise knowledge becomes not just discoverable, but actionable. Reach out to us to learn how our Knowledge Management Platform can unify enterprise data into a single source of truth, embed compliance by design, and support faster, more confident decisions.

Author’s Profile

Dattaraj Rao

Chief Data Scientist, AI Research Lab

Sadashiv Borkar

Senior Data Scientist, CTO AI Research