Traditional fraud detection systems often rely on fixed, one-size-fits-all rules, such as flagging any transaction above a predefined threshold amount. While simple, this approach is fundamentally flawed. It generates a high volume of false positives by flagging legitimate large purchases and, more importantly, fails to catch sophisticated, context-specific fraud that occurs below these arbitrary thresholds.

The modern financial landscape demands a smarter, more adaptive approach.

This is where behavioral spending anomaly detection comes in. Instead of applying the same rules to everyone, it learns what is “normal” for each individual user or account. By creating a personalized baseline of behavior, it can pinpoint transactions that genuinely deviate from a user’s established spending patterns, making fraud detection both more accurate and less intrusive.

Solution: Scalable User-Specific Behavioral Anomaly Detection

A core challenge in anomaly detection in finance is ensuring the model learns what is “normal” for each individual, not just the overall trends. Training a separate model for every user is not scalable for institutions with millions of customers.

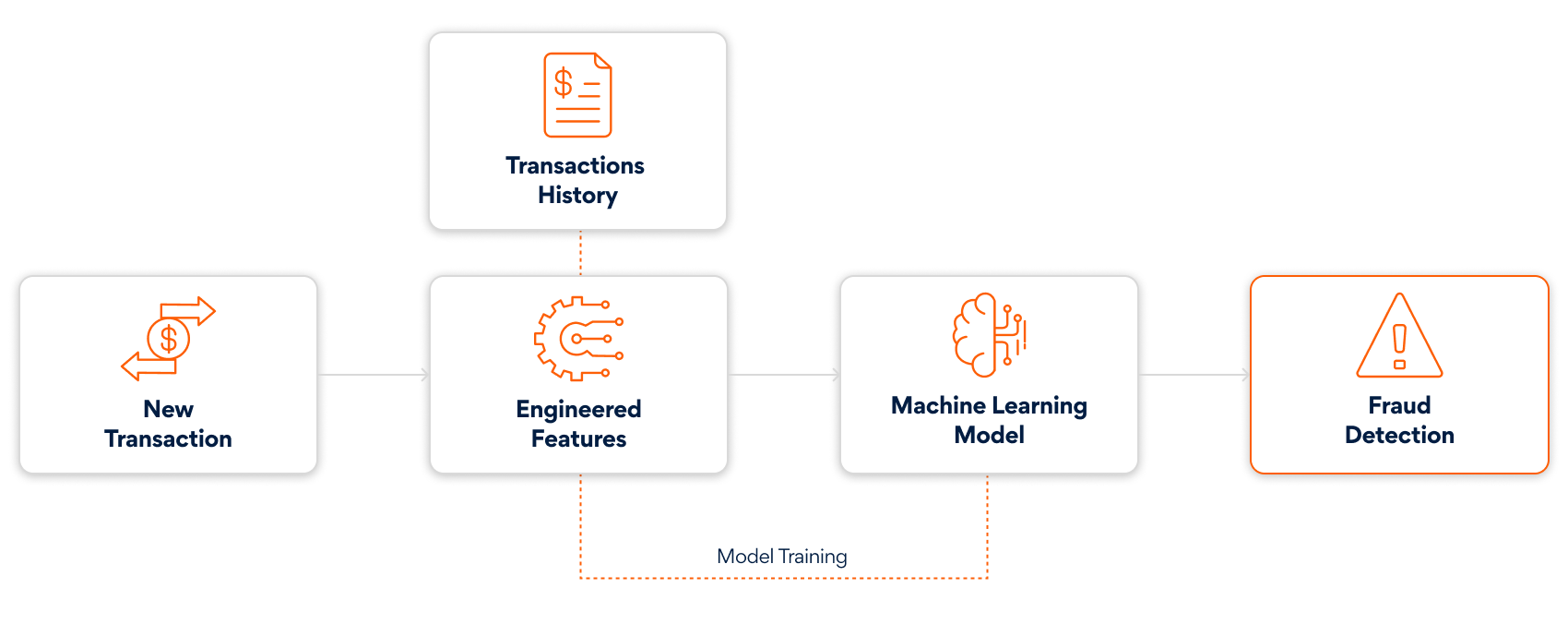

To address this, we use a feature engineering approach that enables a single, global model to deliver personalized detection.

Rather than training on raw transaction data, we compute behavioral features for each transaction, such as spending deviation, transaction timing anomaly, merchant familiarity, and location consistency, relative to each user’s transaction history. These features are designed to capture the context of each transaction in relation to the user’s typical behavior.

We then train a single global model on these features across all users. When a new transaction occurs, we calculate the same parameters for that specific user and pass them to the model for prediction. This approach allows the model to flag anomalies in the context of each user’s unique patterns, delivering both scalability and effectiveness for real-time, user-specific fraud prevention using AI.

How Behavioral Anomaly Detection Works

Learning User-Specific Patterns

For each user or account, the system continuously learns patterns such as:

- Typical transaction amount range – The usual value range in which the user tends to spend.

- Common payment channels used – Frequently preferred transaction methods.

- Preferred categories of merchants – Types of businesses the user regularly interacts with.

- Usual time patterns of spending – Times of day or days of the week when transactions usually occur.

- Frequent geographic locations – Regions where the user generally performs transactions.

- Transaction frequency – Monitors how often the user tends to make the transaction over a given period.

Feature Engineering: The Key to Personalized Detection

Instead of using raw transaction data, the model is trained on features that capture behavioral context, such as:

- Transaction amount – The actual value of the transaction.

- Spending deviation – How typical or unusual the transaction amount is for the user based on their past spending.

- Timing anomaly – Whether the transaction time aligns with the user’s usual patterns.

- New merchant indicator – Flags first-time interactions with a merchant.

- New location indicator – Detects if the transaction took place in an unfamiliar location.

What Types of Transactions Are Flagged?

This approach can flag suspicious transactions such as:

- A high-value payment made at an unusual hour from a foreign country the user has never visited.

- Multiple transactions from distant locations occurring within a short time span.

- A large payment to an unfamiliar merchant from a previously unused device.

Example Scenario

- Normal behavior: A user typically spends moderate amounts daily on essentials like food and transportation, uses familiar payment methods within their home region, and rarely transacts late at night.

- Anomalous behavior: Suddenly, a high-value payment is made to an unfamiliar international merchant using a new device, and the transaction occurs around midnight.

- Detection: The model, analyzing behavioral signals like unexpected amount, time, merchant, and location, instantly recognizes the transaction as a major deviation from the user’s normal pattern and flags it as a high-risk anomaly.

This demonstrates the power of AI for fraud detection when trained on personalized, context-rich features.

Machine Learning Models for Anomaly Detection

Machine learning models, such as Isolation Forest, are well-suited for this task. These models are trained on the engineered features for each user to learn what is typical behavior.

For every new transaction, the same features are computed and passed to the model, which outputs an anomaly score.

Interpreting the Anomaly Score

- The anomaly score indicates how easily a transaction can be isolated from the rest of the user’s data.

- More negative scores (closer to -1) indicate higher anomaly and a greater likelihood of fraud.

- Scores closer to 0 indicate normal activity.

- A threshold is set (based on business needs and validation) to determine when to flag a transaction for review.

Advantages of Behavioral Anomaly Detection

Behavioral anomaly detection offers several important advantages for modern fraud prevention. First, it delivers personalization by learning and adapting to each user’s unique behavior, which significantly reduces false positives. It also provides strong context awareness, evaluating factors such as transaction amount, time, location, merchant, and device, rather than relying solely on transaction value. The approach supports dynamic learning, meaning the system continuously updates as user behavior evolves and improves accuracy over time. Finally, it is highly scalable, making it well suited for large-scale, real-time transaction monitoring across financial institutions that process millions of transactions daily.

Challenges and Considerations

Despite its strengths, this approach comes with several challenges. Data imbalance is a major concern, since anomalies are rare and difficult to model effectively. Evolving user patterns also require the system to adapt over time, which demands regular updates to maintain accuracy. Additionally, feature engineering plays a critical role. Success depends on carefully selecting and calculating features that accurately reflect the context of user behavior.

Why Behavioral Anomaly Detection Works

Behavioral spending anomaly detection powered by machine learning offers a flexible, adaptive, and user-centric approach to identifying suspicious financial activity. By focusing on individual patterns rather than static rules, this method significantly improves fraud detection, reduces false alarms, and scales efficiently to meet the demands of modern financial systems.

Author’s Profile

Arunkumar Chincheti

Senior Software Engineer, Corporate CTO Organization BU

Dinesh Rivankar

Senior Data Scientist, Persistent Systems