Digital Lending

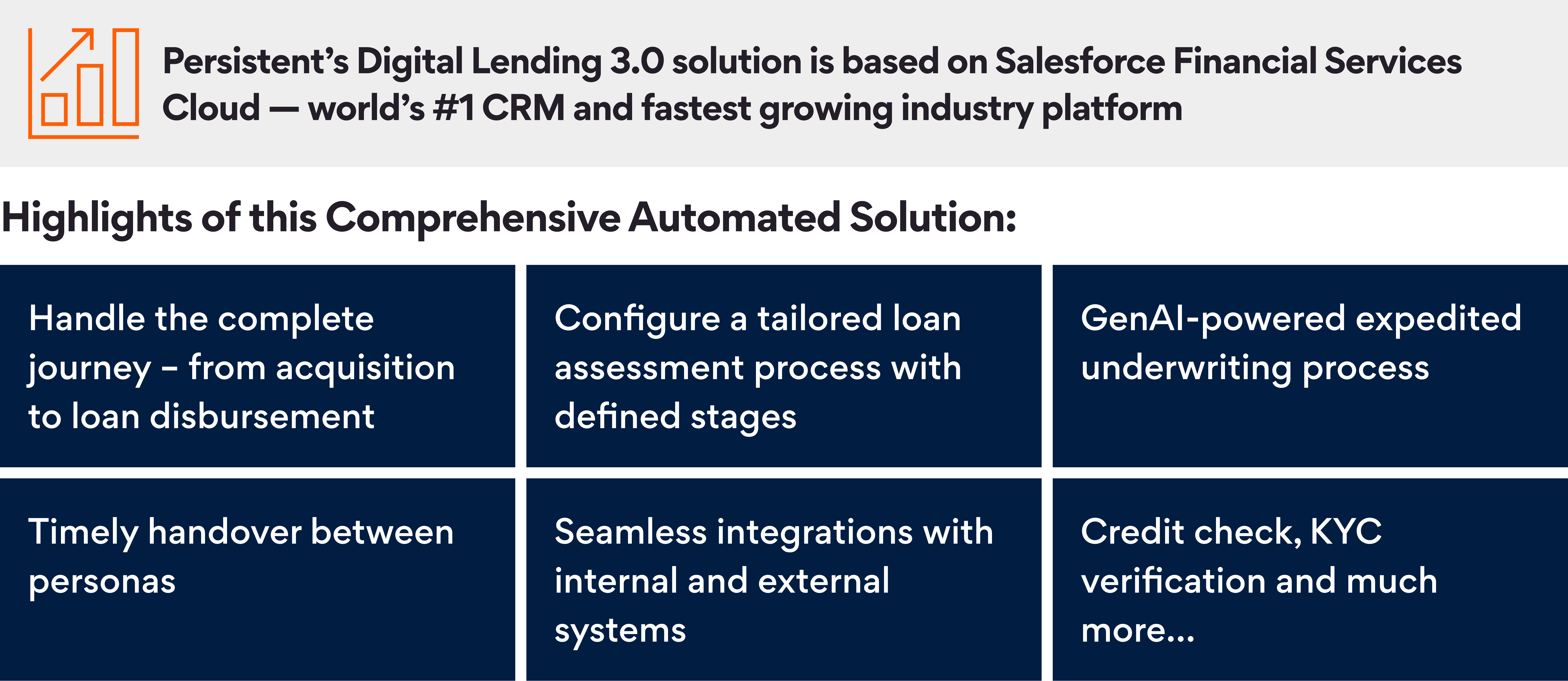

Persistent’s digital lending accelerators simplify your lending journey with its pre-built components that unlock operational efficiency and drive market share within the financial services industry.

Business Benefits

Reduced turnaround time for loan origination, from days to minutes

Reduced operating expenses and total cost of ownership

Faster GTM with customizable loan products

Quicker borrower conversions resulting in business growth

Quick deployment leading to rapid scalability

Customer 360° view allows cross-sell/up-sell opportunities

Solution

Key Personas

Why Persistent?

Lending & Delivery Accelerators

Extensive Lending Experience

Domain & Platform Consulting

Proven LOS framework and SF Best Practices

Customer-Centric Approach

Robust Partner Ecosystem

Persistent’s Credentials

Contact us

(*) Asterisk denotes mandatory fields