Digital payments are on a rise, thanks to the ease of use and speed offered by cashless options like bank transfers, debit or credit card payments, payment gateways, and other methods. In this high-velocity world of digital finance, speed is the currency of success. Yet for risk teams, the same speed becomes an enemy. The rise in digital transactions also brings with it the rising risk of online frauds.

As per a report, consumer frauds are increasing 25% year over year, totalling over $12.5 billion in 2024. Thus, financial institutions face a paradox: they must process transactions instantly, but also ensure that these transactions are genuine. Unfortunately, existing risk systems often lack real-time monitoring capabilities. They are fighting a dynamic, fast-evolving threat landscape with rigid, legacy tools and delayed access to data, leading to detection of a fraudulent transaction only after the crime occurs. This reactive “catch-and-fix” model means the fraud is uncovered only once funds have already moved.

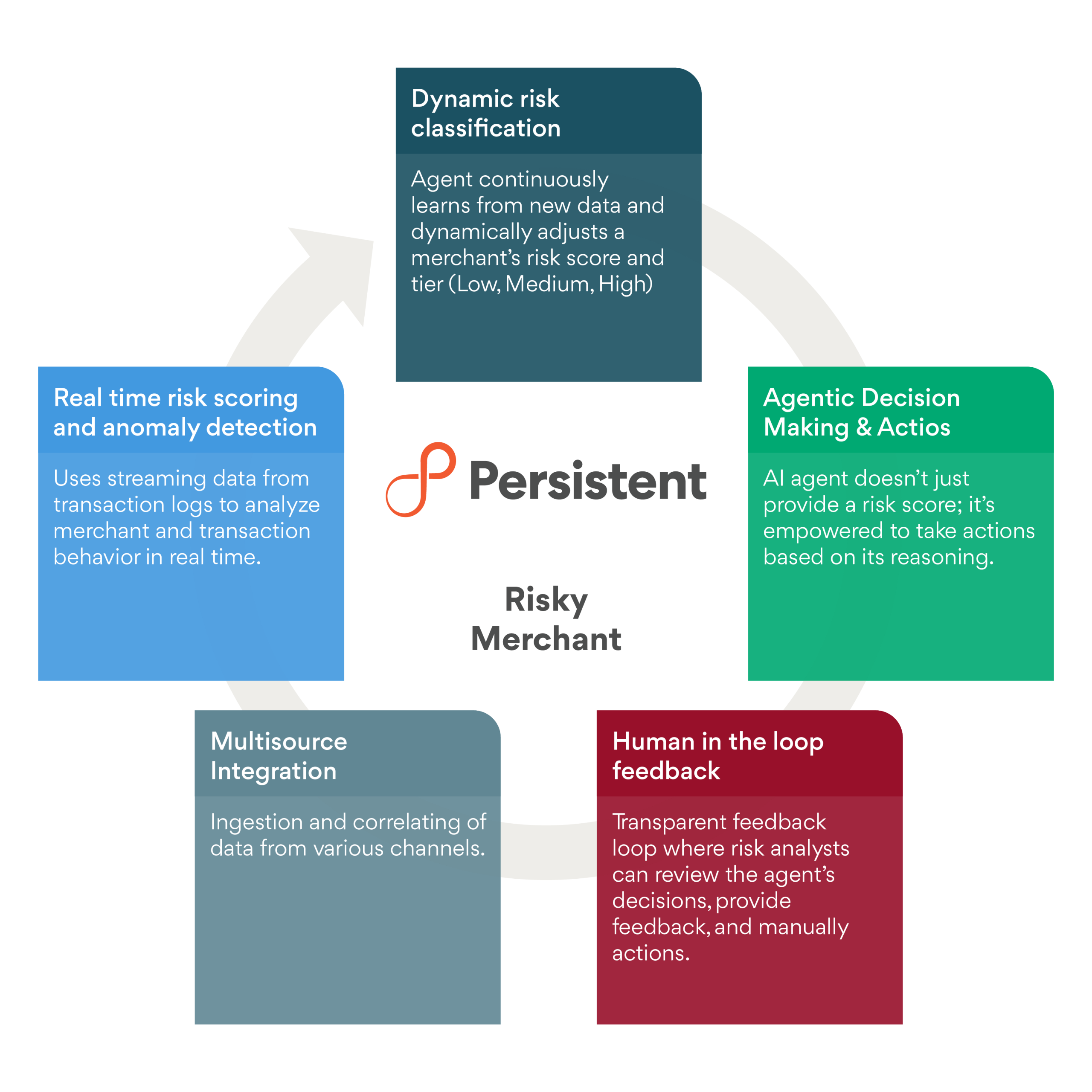

It is time we shift the paradigm. Leveraging Agentic AI on the Databricks Data Intelligence platform, financial institutions can adopt a “predict-and-prevent” posture that protects the ecosystem from unseen liabilities across the portfolio, so that they can offer speed without compromising on risk frameworks.

The Core Problem: The Unseen Liabilities of the Portfolio

All players in the Merchant Servicing Ecosystem are fighting risks that are too fast for manual review and too complex for rules-based systems. While challenges differ by stakeholder, the root cause is the same: rigidity and lack of visibility

| Stakeholder | Role | Financial Risk | Operational Risk | Reputational Risk | Regulatory Risk |

| Acquiring Bank | Creates accounts and settles funds. | High – liable for chargebacks, fines from card networks | Medium – monitoring risky merchants | High – association with fraud resulting in reputational damage. | High – compliance violations |

| Payment Processor | Routes transactions between merchant and card networks. | Medium – fraud losses | High – system strain for fraud checks leading to increased costs | Medium – risk of losing acquirer partnerships | Medium |

| Card Networks | Sets rules, monitors compliance, enforces penalties | Low – indirect financial exposure | Medium – enforcement costs | High – brand trust | High – rule enforcement |

| Issuing Banks | Issues cards to consumers, handles disputes. | High – fraud refunds | Medium – dispute handling | Medium – customer dissatisfaction | Low |

| Payment Gateways | Provides tech layer for online transactions. | Low | High – fraud detection overhead leading to higher operational costs | Medium – may lead to potential blacklisting | Medium |

| ISOs / Aggregators | Onboard merchants, manage relationships | Medium – underwriting liability | Medium | High – reputation hit | Medium |

| Consumers | End users making purchases | Low – personal loss | Low | High – trust erosion | Low |

| Regulators | None | Medium – oversight burden | None | High – enforcement |

There is no off-the-shelf product or solution that can remediate the above risks or potentially pre-empt such risks resulting into minimized impact. However, there is a human + AI approach that can make this system faster, smarter, and more precise over time.

The Solution: A Holistic, Agentic AI Approach

The answer is not “just another risk tool.” It is a strategic defence system powered by Agentic AI, designed natively on the Databricks Lakehouse.

Unlike rule-based systems, this approach uses Databricks’ unified data intelligence platform to bring together real-time transaction data, external signals, and compliance inputs into a single intelligence layer. Because data processing, feature engineering, model training, inference, and monitoring all run on Databricks, the Agentic AI system can reason across all signals in one governed environment, make informed decisions, and recommend next-best actions with full traceability.

How It Works: The Three Pillars of Defence

For risk teams to truly outpace the threats posed by financial fraud, they need a system that doesn’t just react but actively flags and adapts to the risks. The three pillars of defence form the backbone of this defence strategy, ensuring that risks are kept in check with the combination of proactive intelligence and human oversight.

- Pillar 1: Vetting Prior to First Transaction (Initial Risk Scoring)

Post onboarding-and before the merchant processes any transaction, the system performs an intelligent, multi-signal check using features engineered, versioned, and served through the Databricks Feature Store. These features feed a ML model, which evaluates parameters like business model attributes, social sentiment, compliance history, and generates a precise, data-backed risk score that helps pre-empt bad actors from entering the ecosystem and enables early, proactive risk mitigation. - Pillar 2: Continuous, Multi-Signal Monitoring

Once onboarded, the merchant is monitored by an “always-on sensor” proactive monitoring system. The system doesn’t just look at transaction logs; it continuously ingests and synthesizes disparate data points including:- Transaction Data: Volume, velocity, and chargeback rates

- Compliance Databases: Sanction lists, adverse media, and legal actions

- Social Signals: Customer reviews and social media sentiment

- Pillar 3: Automated, Intelligent Action

This is the core of the “agentic” capability. Built on the Databricks Lakehouse and orchestrated through the Mosaic AI platform, the system doesn’t just send notifications. It can trigger governed, real-time actions. Based on its reasoning and model outputs, it can place holds on funds, add merchants to a watchlist, or block transactions in real time, all within the controls enforced by Unity Catalog.

The most important part is that every automated action is executed with a human-in-the-loop framework. The system prepares the recommendation and the evidential rationale, while a human reviewer authorizes the final action. This ensures that all transactions pass through a compliant, supervised decision flow. The AI eliminates latency by preparing decisions instantly, while humans provide oversight to maintain regulatory, ethical, and operational integrity.

The Hybrid Model: Accuracy Meets Intelligence

The real breakthrough in merchant risk management isn’t just about deploying more Artificial Intelligence (AI) or automation. It is about building a system where machine precision and intelligence can work hand-in-hand with human feedback and experience. This hybrid architecture engineered on the Databricks Data Intelligence Platform is far more robust than “LLM-only” approaches, ensuring that enterprises can get:

- The Precision Layer: Deterministic ML models trained and versioned with MLflow and Feature Store to deliver accurate, reproducible risk scores based on governed, real-time data.

- The Reasoning Layer: The Mosaic AI platform provides the foundation for building operational agents that interpret model outputs, correlate data signals, explain decisions in natural language, and drive workflow actions.

- Human + Machine Collaboration: Mathematical precision meets human-like reasoning, fully governed, monitored, and secured on Databricks.

Quantifiable Business Benefits

Organizations embracing Agentic AI on the Databricks Data Intelligence Platform are unlocking new levels of operational efficiency, elevating risk detection accuracy, and strengthening trust across the financial ecosystem. By combining scalable intelligence with transparent, explainable workflows, financial institutions can transform complexity into actionable insight, resulting in:

- Financial Protection: 20–40% reduction in chargeback and fraud losses; 30–60% improvement in detection accuracy.

- Operational Excellence: 50–70% reduction in manual reviews, freeing analysts to focus on high-value investigations.

- Reputation & Compliance: Complete assurance against onboarding known bad actors, with clear, explainable audit trails that reduce regulatory exposure.

The Future is Predict-and-Prevent, Not Catch-and-Fix

The future of risk management belongs to institutions that can anticipate, not react. Agentic AI on the Databricks Data Intelligence Platform provides the intelligence, scale, and governance needed to build a continuously learning defence posture.

At Persistent, we are combining human intellect, Agentic AI, and the power of Databricks to help financial institutions build resilient, intelligent, and explainable risk defences. Our approach enables precise, efficient, and auditable risk management so you can safeguard trust, strengthen oversight, and lead with confidence in a volatile digital economy.

Contact us to reimagine and embrace the future of financial risk management