Dubbed as the year of cyber pandemic, 2025 continues to witness unprecedented sophistication and frequency of targeted attacks, especially in the financial sector. A Crowdstrike report on cyber-attacks found observed intrusions have almost tripled for the financial sector compared to the previous year. Most of these attacks are highly advanced phishing or vishing attempts, and social engineering attacks that try to gain foothold into secure networks.

In a highly regulated sector such as banking, cyber-attacks carry penalties and a cost of compliance. Banks and financial institutions must invest in cyber vigilance with an equal focus on complex compliance requirements (fraud detection and anti-money laundering), while ensuring speed and scale of service delivery. The need of the hour is to proactively identify threats and fraudulent activities and significantly reduce time to action, while maintaining speed and ease of valid transactions.

Minimizing Critical Window with AI Agents

With a high influx of data and changing ground realities, AI and machine learning can help banks pick needles in haystacks. Until recently, AI in banking risk management primarily flagged suspicious activities, still leaving the decision-making to human advisors. While this reduced manual effort and accelerated investigations, it also left a critical time window where threats could slip through. Moreover, a surge in AI monitoring tools based on static rules created noise and false positives that blocked or processed transactions without validation, risking regulatory scrutiny.

AI agents can bridge the decision-making gap by not only detecting anomalies, but acting on cues by understanding contextual, historical, and semantic data, without human intervention. With real-time assessment and actioning, AI agents can help banks level up to emerging threats and evolving regulatory requirements, ensuring integrity, security and trust in a dynamic landscape.

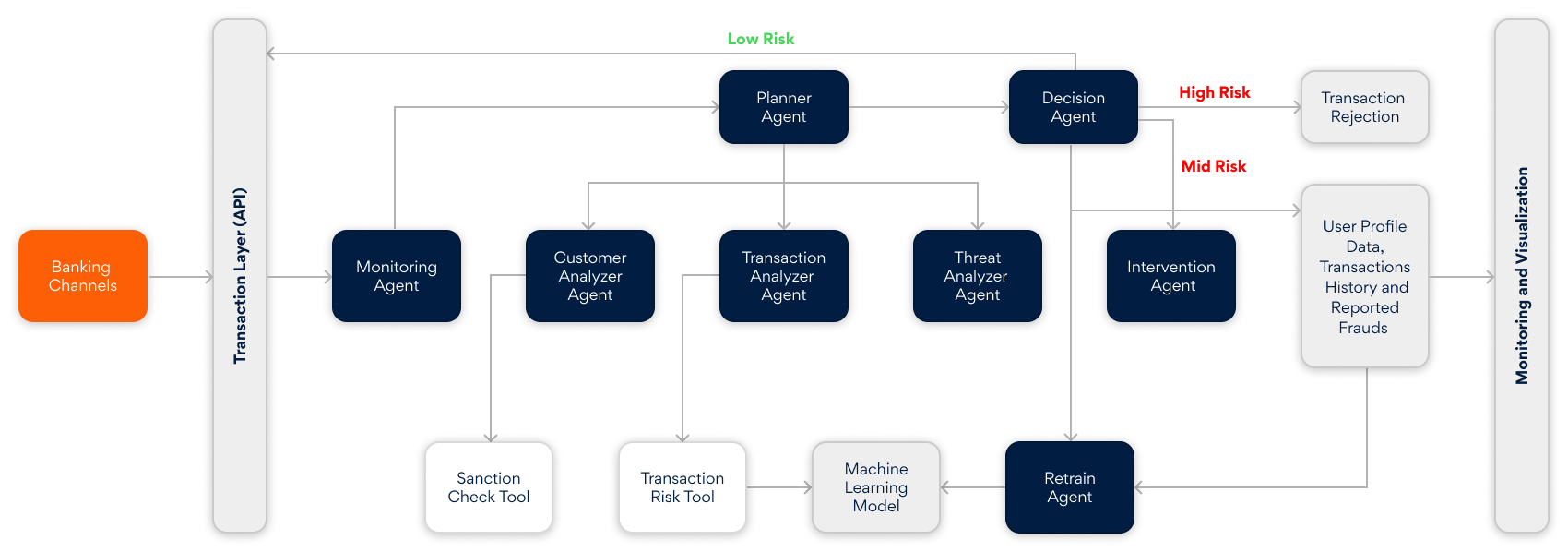

Behind-the-scenes agentic orchestration for risk mitigation:

- A detection agent continuously scans transactions against behavioral baselines.

- A validation agent cross-checks device, location, and account metadata with fraud intelligence feeds.

- A risk-scoring agent aggregates findings and translates patterns into a unified risk score.

- A decision agent applies regulatory rules, historical outcomes, and customer risk profiles to decide on approval, step-up authentication, or blocking.

Instead of acting independently, these agents communicate and validate one another’s outputs before a decision is made. This collaborative approach minimizes blind spots and helps the system strengthen its conclusions over time.

To safeguard genuine transactions, the agentic system deploys a multi-signal consensus approach, ensuring that transactions are only blocked when multiple AI agents concur on the level of risk. Each blocked transaction is supported by an explanation that details which agent flagged the activity and the reasoning, offering clarity and compliance with regulatory audit standards. A continuous feedback loop allows the system to quickly correct false positives, retraining itself to minimize the likelihood of repeating such errors.

Agentic AI in action: A customer tries to make a large transfer at an unusual hour. The system immediately detects that this transaction contradicts the customer’s typical behavior and notices that the recipient’s account has a recent history of fraud. It also identifies a surge in similar suspicious activities in the region. Based on combined risk factors, the system assigns a high-risk score and blocks the transaction for further review, while updating its models to better recognize such threats in the future.

Persistent Agentic AI Solution for Financial Risk Management

Persistent introduces an Agentic AI model designed to advance risk management capabilities for banks. The AI model is modular, scalable, and explainable, integrating seamlessly with contemporary AI-driven cybersecurity frameworks and intelligent automation to support banking security initiatives.

Our solution delivers:

- Operational efficiency: By reducing manual tasks and tool-switching, our AI agents improve efficiency, save time and lower costs. Real-time learning improves accuracy and adaptability, minimizing errors and future losses.

- Compliant by design: Every transaction enhances the system’s intelligence. By integrating user data, historical activity, and past fraud, it not only improves detection but also maintains compliance with anti-money laundering, Know Your Customer, and audit requirements.

Key Components

- Machine learning model for:

- Pattern recognition: Scans transactions for frauds or anomalies using historical and real-time data.

- Scoring: Assigns risk scores to transactions based on learned correlations, adapting sensitivity over time through retraining.

- Continuous learning: Refines detection by updating its parameters with every verified fraud or false positive case

- Agentic orchestration for:

- Coordination: Aggregates risk scores and findings from multiple agents for consensus before acting.

- Decision-making: Determines transaction outcomes (approval, step-up authentication, or blocking) based on model outputs, system rules, and regulatory guardrails.

- Guardrail enforcement: Applies checks to minimize wrongful blocking and ensure genuine customer transactions are not affected, maintaining compliance and user trust.

- Explainability: Documents the reasoning behind every action, supporting audits and building transparency with customers and regulators.

- Contextual response engine for:

- Seamless approval: Low-risk transactions proceed uninterrupted to maintain user experience

- Smart intervention: Medium-risk cases trigger step-up authentication or are routed to expert analysts.

- Proactive blocking: High-risk activities are halted immediately and escalated for investigation, preventing financial and reputational damage.

- All decisions, interventions, and transaction metadata are logged and visualized to support regulatory audits, performance reviews, and internal investigations.

- Agentic design with Google ADK: We leveraged Google Agent Development Kit to design autonomous, modular agents that govern each component of the system to:

- Operate independently to handle surveillance, scoring, verification, and learning.

- Communicate seamlessly, enabling distributed yet coherent decision-making.

- Self-optimize through reinforcement mechanisms, continuously refining their policies and rules.

Strategic Edge Through AI

At Persistent, we empower banks to proactively mitigate risks and strengthen their security posture with our advanced AI-driven real-time risk assessment and banking security solutions. Our expertise ensures your institution stays ahead of evolving threats, safeguards customer trust, and delivers seamless, secure banking experiences. Partner with us to future-proof your financial operations and achieve robust, compliant protection.

Author’s Profile

Pooja Kamat

Data Scientist, Corporate CTO

Dinesh Rivankar

Senior Data Scientist, Persistent Systems