In an era of constant transformation within the payments industry, certain shifts hold greater significance than others. With an array of intricate and international business exchanges defining the modern landscape, the payments sector is gearing up for a monumental transition with ISO 20022. This migration is poised to become the one of the most significant of the century, addressing the diverse, numerous, and sophisticated payment transactions that characterize the current business environment. Concurrently, the banking sector, still reliant on the antiquated SWIFT MT message set, is witnessing an escalating demand for MT-MX conversion services.

Understanding the SWIFT MT/MX Standards

The conduit through which financial institutions communicate messages on the SWIFT network is the SWIFT message types of formats or schema. Initially crafted by SWIFT, a subset of these message types took the form of ISO 15022, popularly referred to as SWIFT MT. Over time, this evolved into an ISO standard, primarily employed for custodian communications. Subsequently, the XML-based iteration emerged under ISO 20022, known as SWIFT MX.

SWIFT MT’s Transition: The Driving Factors

The transition away from the MT standard is largely prompted by the advantages offered by the XML-based MX standard, notably its seamless integration into Straight-Through Processing (STP) systems within IT infrastructure.

Key Changes from SWIFT MT to MX

The upcoming changes from SWIFT MT to MX are set to reshape various categories:

- SWIFT MT 1 series: Customer payments

- SWIFT MT 2 series: Financial institution payments

- SWIFT MT 9 series: Statements

Differentiating MT from MX

MT messages, structured according to the ISO 15022 standard using the FIN protocol, are identified by a three-digit code representing the message category, group, and type. On the other hand, MX messages adhere to the ISO 20022 standard, utilizing the XML protocol. Comprising four parts, an MX message incorporates four identifiers: message type, message number, message variant, and version number. The richness of data in MX messages is evident with the example of a single customer credit transfer MT 103, appearing as pacs.008.001.0x in MX format. With 940 fields, MX messages offer enhanced structure, robustness, and comprehensive data.

Transition Timeline for Financial Institutions

The migration to the MX format will be a gradual process, varying across nations and regions. Commenced in November 2022, cross-border and high-value payments within the European Union, including those to Target2 and the wider SWIFT Network, will take the lead. In November 2023, the U.S. Federal Reserve will undertake the transition. However, until 2025 (as designated by SWIFT), both MT and MX formats will coexist.

Benefits of ISO20022-Powered SWIFT MX

The ISO 20022 standard introduces profound benefits that fuel the adoption of SWIFT MX

- XML-Based Format: Facilitating STP in IT systems

- Multilingual Support: Accommodating non-Latin alphabets

- Data-Rich Messages: Enabling enhanced data mining and reconciliation

- Regulatory Compliance: Streamlining regulatory reporting, AML, and sanctions checks

- Elevated Customer Service: Fostering improved customer experiences

- Enhanced Reconciliation: Facilitating automatic reconciliation between invoices and payments

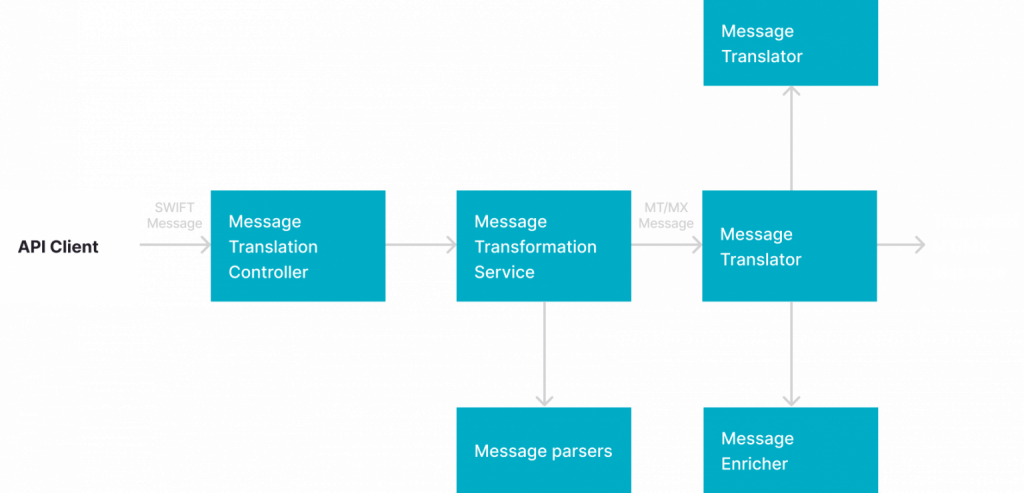

SWIFT Xform – A Solution from Persistent for MT/MX Message Transformation

This accelerator accepts all payment types (cross country, cross currency to local payment types) in MT format and converts them into a standard ISO20022 (MX) message for the downstream systems to consume and process as shown in the figure below.

As the payments landscape undergoes a paradigm shift, embracing the transition from SWIFT MT to MX standards emerges as a strategic move. The move to MX heralds a new era of enriched data, streamlined processes, and enhanced customer-centric services, marking a transformative leap forward for the payments industry.