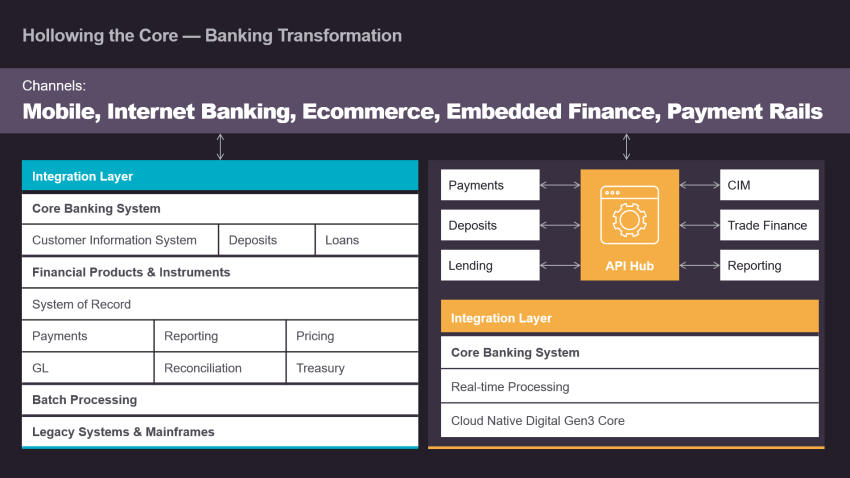

Sales pitches directed at majority of banking behemoths today are themed around “Hollowing the Core”. The definition is pretty straightforward – we unbundle modules of the Core Banking systems that are central to modern-day banks, with products and platforms uniquely catering to individual customer journeys. The transformation dutifully replaces every functionality built into the CBS (Core Banking System) with newly architected applications and workflows. This makes the core lightweight and builds flexibility and scale into the bank’s technology ecosystem.

Its not very radical if we understand the genesis of Digital Banking cores across decades. Most of the core banking systems began as nimble SORs offering reliable ledger and bookkeeping services. I recollect numerous stories narrated by senior veterans that talk about standalone Cores that were limited to individual branches and locations. As time passed and technology improved, more and more of traditional paper-based banking activities came to be absorbed into the CBS (Core Banking System). Naturally as the journey was incremental and largely ad-hoc, the bank stack today is fraught with data redundancies and considerable technical debt. This helps us infer that the monoliths today were disrupting challengers a couple of decades ago.

Hollow-the-core doesn’t imply discarding the legacy stack and building a New Digital Banking ecosystem altogether. It merely empowers the modern CIO to leverage Next-gen products, Integration toolkits and Data Pipelines to lighten the Core and build a flexible Cloud Native Bank ready to superscale.

The transformation journey is human-intensive and requires a deep understanding of the banking domain to facilitate rapid decision-making and stakeholder management. The people aspect is critical as Banking as a domain has massive compliance inertia to overcome. An agile team with hands-on Core Banking expertise, Data engineering capabilities, and comprehensive domain knowledge is a key success factor and an assurance of success.

We, at Persistent, present the LEAP framework that addresses each aspect of the transformation –

Leverage

Assess and understand the existing technology landscape with challenges around new functionalities and struggles with existing operations. We rationally utilize technology resources for the identification of targets for hollowing out. This stage ensures we don’t expedite indiscriminate “Core Unbundling”, and map a smooth Platformification journey.

Envision

Visualize an articulate target end state that addresses all the aforementioned challenges with the desired features and functionalities. Here we brainstorm about the individual modules we want to build as part of the larger banking ecosystem. Pure-play domain design exercise wherein we gauge consumer demand, product aspirations, and functional baggage.

Architect

Create an implementable layout with key stakeholders, infrastructure details, product list and business workflows that lead to our target end state. Here we develop a robust steel frame that accommodates the essentials of our Modern Banking Platform with a key focus on resources, techstacks and digital roadmap.

Program

Procure resources, finalize project plan, set milestones and manage incremental progress with a dedicated project management office. Execute the roadmap to success with appropriate checks and balances for realizing an agile and well-integrated Digital Native Bank for the Future.