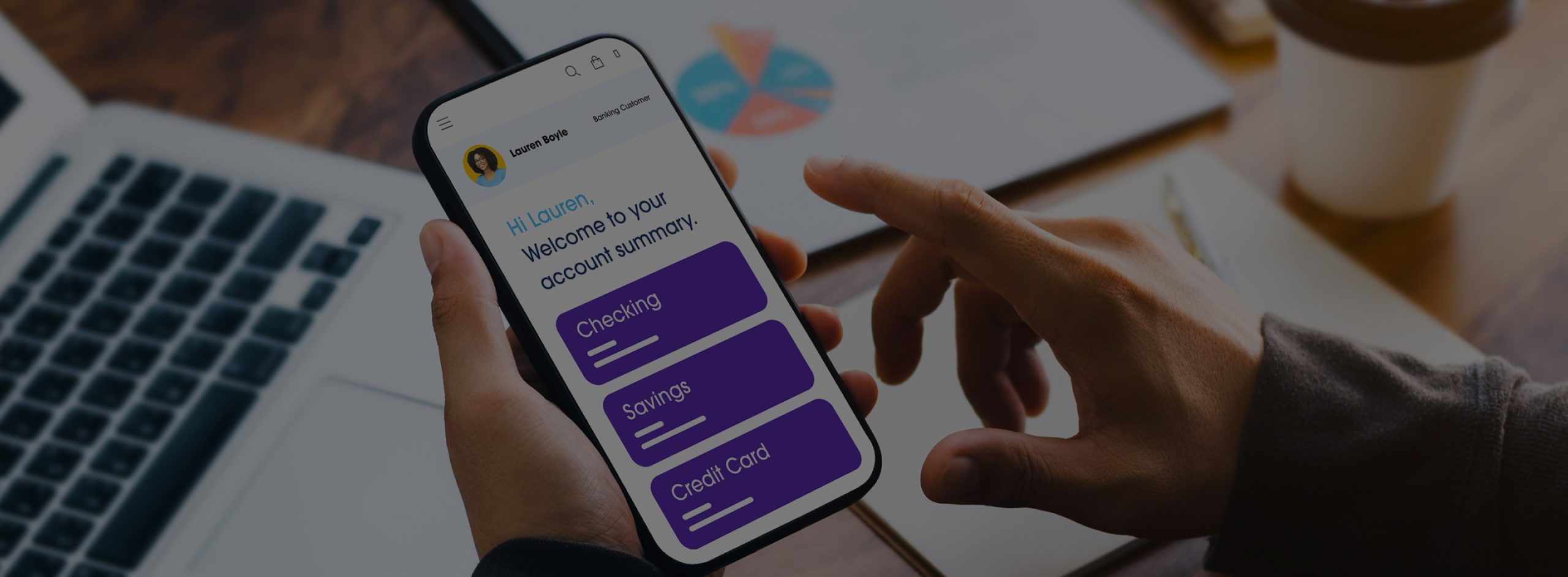

Banking & Financial Services

Deliver world-class digital financial services enabled by streamlined operations.

Featured Insight

As traditional institutions and fintechs alike strive for growth and to improve margins, reducing complexity and optimizing operations is imperative to deliver differentiated experiences. We help our clients to achieve this through the implementation of a digital mosaic of disruptive technologies – empowering them to deliver hyper-personalized financial services that are valued by their customers.

Deliver AI-Powered Intelligence in BFSI

Learn moreWhy Persistent?

Deep Industry Expertise

Domain experience derived from working with leading financial institutions, as well as innovative fintechs and smaller institutions across all industry sectors.

Technology Insights

Over 30 years of experience working with cutting edge technologies, we leverage these insights to help clients build technology-driven solutions that deliver business results.

Robust Partner Ecosystem

Established partnerships with leading platform providers and fintechs that enable you to build the right solution for today and the ability for innovate for tomorrow.

Salesforce for Banking and Financial Services

Elevate your financial strategies with the Financial Services Cloud. Our comprehensive offerings combine Persistent’s Salesforce and domain proficiency, human-centered design, and data + AI expertise.

Learn moreLearn About Our Key Partners

Contact us

(*) Asterisk denotes mandatory fields